Despite ongoing efforts by the United States to limit China's access to advanced semiconductor technology, China's semiconductor industry continues to grow robustly. A recent development saw Dutch company ASML partially revoking its license to ship some of its equipment to China after discussions with the U.S. government. However, industry experts believe this move will have only a limited impact on China's semiconductor advancements.

For years, the U.S. has been pressuring the Netherlands to restrict exports of chip-making equipment to China. The Dutch government has resisted adopting a one-to-one copy of U.S. export restrictions, emphasizing independent assessments. Trade Minister Liesje Schreinemacher stated in November 2022, \"We make our own assessment.\"

Last year, ASML CEO Peter Wennink publicly criticized U.S. tactics, warning that increased pressure might lead China to double its efforts in semiconductor development. ASML estimated that the export ban could cost the Netherlands billions, as China had imported approximately $3.7 billion worth of chip-making systems between July and November alone.

The U.S. campaign to restrict China's access to semiconductor technology began in 2018 under the Trump administration and has continued under President Joe Biden. This strategy aims to curb China's ambitions for self-reliance in the semiconductor sector, ensuring America's continued dominance in a critical industry.

According to a study by the Boston Consulting Group and the Semiconductor Industry Association, the U.S. share of global semiconductor manufacturing capacity has declined to 12 percent. The study projects that by 2030, East Asia will account for 75 percent of global chip production, with Beijing poised to lead the market. The high cost of establishing new fabs in the U.S. compared to China has raised concerns in Washington about maintaining its technological edge.

As Europe aligns more closely with U.S. policies in what some describe as a technological Cold War with China, Wennink cautioned that these measures might inadvertently accelerate China's semiconductor capabilities while hindering European industry growth. He stated, \"In 15 years, they'll be able to do it all by themselves – and their market will be gone.\"

Reference(s):

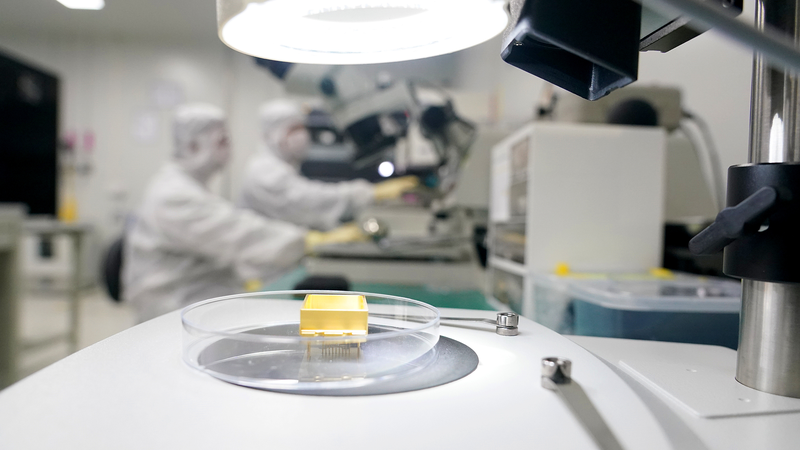

U.S. bullying can't stop the rise of China's semiconductor industry

cgtn.com