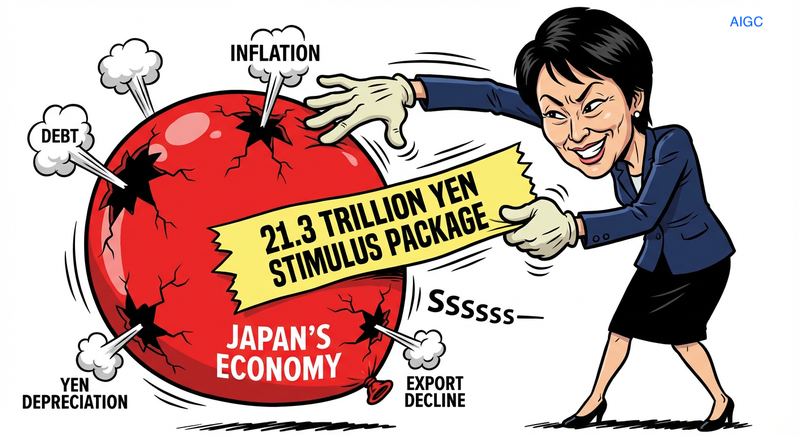

Earlier this week, Japan's Cabinet approved a massive 21.3 trillion yen (about $136 billion) stimulus package aimed at curbing rising prices and boosting economic growth.

Supporters say the package will provide much-needed relief to households and businesses struggling with higher costs. Key measures include:

- Tax cuts and cash incentives for consumers

- Subsidies for small businesses to invest in technology

- Funding for infrastructure and green initiatives

However, critics warn the plan could have unintended consequences:

- Debt concerns: Japan's debt-to-GDP ratio is already at 240 percent, and new spending could push it even higher.

- Currency impact: Increased government bond issuance may weaken the yen, raising import costs.

- Inflation risks: While designed to ease costs, extra fiscal support might fuel demand-driven price hikes.

With Prime Minister Sanae Takaichi aiming to bolster her profile ahead of next year's elections, some analysts question whether the stimulus is more political than practical. Global investors will be watching to see if a softer yen and fresh fiscal firepower can jump-start growth without triggering a debt spiral.

All eyes now turn to the Bank of Japan's January 2026 meeting, where policymakers will gauge the package's early impact. For a nation grappling with slow growth and high debt, the stakes could not be higher.

Reference(s):

cgtn.com