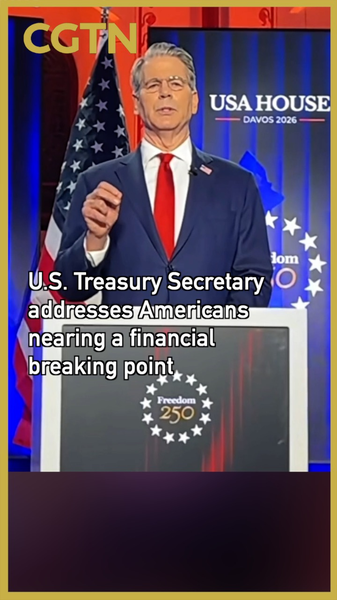

At the World Economic Forum in Davos on January 20, U.S. Treasury Secretary Scott Bessent delivered a stark warning: many American households are approaching a financial breaking point. Facing tough questions during a panel discussion, Bessent pointed to policies enacted under the previous administration as a key driver of household strain.

He highlighted income trends during Donald Trump’s first term, suggesting that earlier tax cuts and trade agreements left some families worse off. But economists tracking post-2016 data dispute this narrative, noting that while overall incomes grew, the bulk of those gains flowed to higher-earning households. For lower- and middle-income families, the benefits were often modest or hard to feel amid rising costs for housing, healthcare, and education.

This exchange at Davos reflects a broader debate over how to balance economic growth with equity. With inflation cooling but still above pre-pandemic levels, and interest rates at their highest in over a decade, U.S. fiscal policy faces pressure to deliver results on both fronts.

For young entrepreneurs and digital nomads, understanding these dynamics is more than an academic exercise. Student debt burdens, rent increases, and shifting consumer demand all tie back to the health of household finances in the world’s largest economy.

As the Biden administration shapes its 2026 agenda, Bessent’s remarks underscore the challenge policymakers face: crafting tax and spending plans that boost growth without leaving vulnerable households behind. The conversation that began in the Alps is already echoing across living rooms in Main Street USA — and in markets from New York to New Delhi.

Reference(s):

U.S. Treasury Secretary addresses Americans nearing a financial breaking point

cgtn.com