U.S. Small Business Sentiment Sours Amid Tariff Worries

CNBC survey: 66% of U.S. small business owners feel impacted by tariffs, 70% foresee a recession, and over 60% report stress over finances and consumer demand.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

CNBC survey: 66% of U.S. small business owners feel impacted by tariffs, 70% foresee a recession, and over 60% report stress over finances and consumer demand.

Amid tariff threats, US reliance on global trade is slipping. With just 13% market share, can America dictate terms? Data shows partners can quickly adapt.

A 0.3% GDP contraction in Q1 2025, 10% tariffs on imports and ripple effects from 700,000 potential job losses to a $1,000 hit per household. How will U.S. businesses adapt?

New data shows U.S. consumer confidence fell to its lowest since May 2020 amid fears tariffs will drive up living costs.

CNN poll: 59% of Americans say President Trump’s policies have worsened the economy, with rising living costs and low optimism on the financial outlook.

As US manufacturing roars back, a Cato survey shows 80% support vs 25% willing to work in factories, exposing a growing workforce gap.

U.S. tariffs have raised costs for businesses and consumers, sparking retaliatory measures and market jitters. Entrepreneurs warn a trade war ‘not good for anyone’ as price hikes bite.

Explore how the U.S. manufacturing slump is self-inflicted—from a lost Moonshot engine to automation and tariffs—and what it takes to reignite industry.

US trade wars and rising protectionism spark a global debate on economic policies and lessons from history.

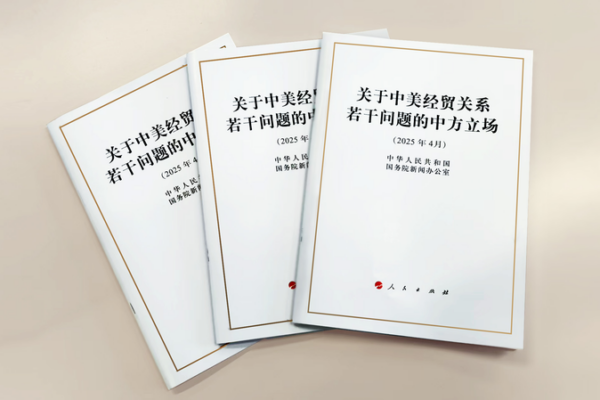

China’s new white paper clarifies its stance on U.S. economic and trade ties, stressing mutual benefit and balanced relations.