Chinese Mainland–U.S. Trade Talks Wrap Up in Malaysia

Economic and trade talks between the Chinese mainland and the U.S. concluded in Malaysia, hinting at new opportunities for global entrepreneurs and changemakers.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

Economic and trade talks between the Chinese mainland and the U.S. concluded in Malaysia, hinting at new opportunities for global entrepreneurs and changemakers.

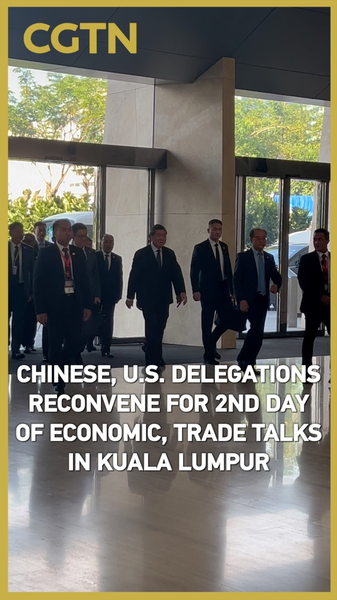

Delegations from the Chinese mainland and the U.S. reconvened in Kuala Lumpur for the second day of trade talks, aiming to address key economic issues in line with leaders’ consensus.

The Chinese mainland and U.S. delegations meet in Kuala Lumpur for day two of trade talks, aiming to expand a $650B partnership and map new pathways in tech, agriculture, and renewable energy.

The first day of China-U.S. trade talks wrapped up in Kuala Lumpur, with the Chinese mainland delegation departing as both sides gear up for Day 2 on tariffs, digital trade, and sustainability.

Day one of the Chinese mainland–U.S. economic and trade talks wrapped up in Malaysia, setting the stage for deeper discussions on trade partnerships and market access.

Day 1 of Chinese mainland and U.S. trade talks wraps up in Kuala Lumpur, led by Vice Premier He Lifeng. Sessions run through October 27.

Delegations from the U.S. and the Chinese mainland kicked off economic and trade talks in Kuala Lumpur, following consensus from their heads of state earlier this year.

Chinese Vice Premier He Lifeng will meet U.S. officials in Malaysia Oct. 24-27 for economic and trade consultations, a key step for global markets.

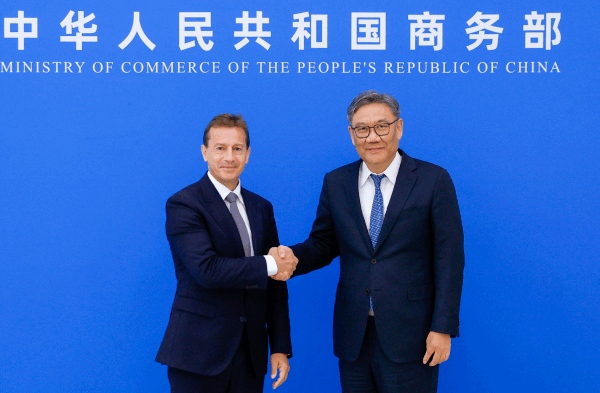

Chinese mainland Commerce Minister Wang Wentao and Airbus CEO Guillaume Faury discuss expanding aviation ties, the new Tianjin A320 assembly line, and securing global supply chains.

China27s commerce ministry urges the US to correct missteps and show sincerity in rare earth export talks, defending its measures as legitimate and law-based.