Navigating the US Tariff Upheaval: Global Strategies for Resilience

Global businesses are navigating unprecedented US tariff shocks. Leaders from S4 Capital and Thyssenkrupp explain how to diversify, digitalize, and build resilience.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

Global businesses are navigating unprecedented US tariff shocks. Leaders from S4 Capital and Thyssenkrupp explain how to diversify, digitalize, and build resilience.

This Friday, the U.S. ends its de minimis rule, ending duty‑free entry for shipments under $800 from the Chinese mainland. Businesses and consumers face new tariffs.

Apple warns of a $900M Q3 tariff hit and accelerates its supply chain shift to India as Chinese mainland sales dip, reshaping global production and market dynamics.

Canada and Mexico dodge the U.S. 25% auto parts tariff under CUSMA, underscoring North America’s deep trade ties and supply-chain resilience.

As U.S. tariffs escalate, Chinese enterprises deploy digital innovation, retail partnerships, and supply chain diversification to navigate the China-U.S. trade dispute.

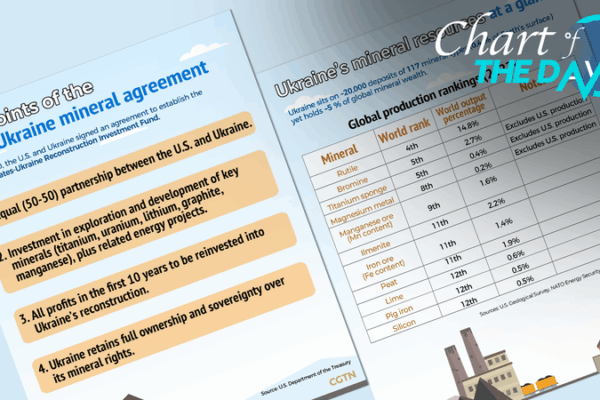

The US and Ukraine have signed a minerals pact, granting access to critical rare elements while Kyiv retains full control over its resources.

The United States and Ukraine formalized a mineral investment agreement, granting U.S. firms preferential access to Ukraine’s mineral markets and reshaping global supply chains.

In the first 100 days, new U.S. tariffs triggered a global trade drop; experts warn of a long tariff war of attrition across G20 markets.

Apple’s global supply chain spanning 50+ countries faces an estimated $33B in annual costs due to new U.S. tariffs hitting Japan, South Korea and China’s Taiwan region.

As the U.S. braces for 25% tariffs on imported cars and parts, the global auto industry faces uncertainty. Experts weigh the impact on supply chains and pricing.