Chinese mainland’s Economy Grows 5% in H1 2024 Amid Real Estate Slump

Chinese mainland’s GDP grew by 5% in the first half of 2024, boosting investor confidence despite a significant slowdown in the real estate market.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

Chinese mainland’s GDP grew by 5% in the first half of 2024, boosting investor confidence despite a significant slowdown in the real estate market.

Shanghai introduces a major policy package aimed at stimulating its property market by easing home-purchase restrictions and adjusting down-payment ratios.

China’s Loan Prime Rate remains unchanged in May as the government introduces measures to support the housing market and potentially lower mortgage rates.

The Chinese mainland has introduced historic real estate policies aimed at boosting the housing market, including lower down payments and loan rates.

The Chinese mainland has removed mortgage floor rates and lowered down payment ratios to ease housing costs and boost the economy, aiming to stabilize the housing market and enhance consumer spending.

The Chinese mainland cuts mortgage loan rates starting May 18 to make homeownership more affordable and boost the housing market.

The Chinese mainland’s central bank unveils a $42 billion relending facility to support government-subsidized housing, aiming to provide affordable homes through state-owned enterprises.

Hangzhou removes new housing purchase restrictions, allowing non-city residents to apply for Hukou and access benefits. This move aligns with China’s 2024 strategy to innovate real estate development.

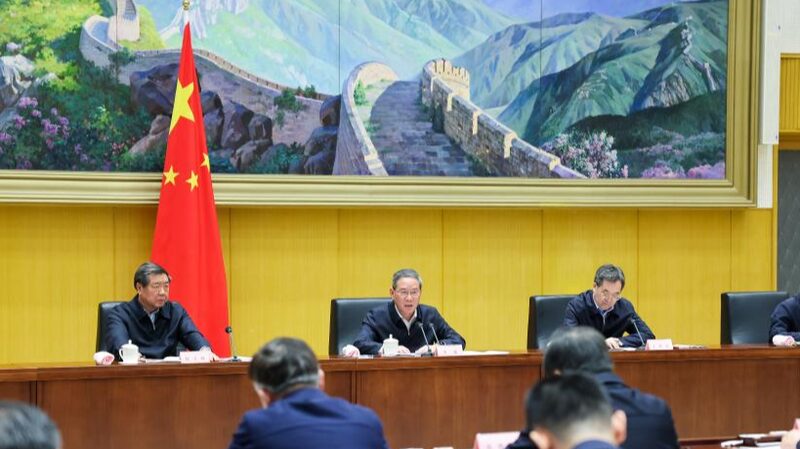

Chinese Premier Li Qiang leads efforts to refine real estate policies, ensuring housing project delivery and market stability.

The National Association of Realtors settles lawsuits alleging commission inflation, agreeing to pay $418 million and revise payment structures.