Northeast China Gears Up to Build Its Own Snowboards

Research teams in the snowy northeast of the Chinese mainland are prototyping homegrown snowboards, aiming to bring manufacturing from lab to local slopes within a few seasons.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

Research teams in the snowy northeast of the Chinese mainland are prototyping homegrown snowboards, aiming to bring manufacturing from lab to local slopes within a few seasons.

Africa is shifting from raw exports to domestic manufacturing by forging equal partnerships, building critical infrastructure and empowering local talent.

The Chinese mainland’s industrial production rose 4.8% in November 2025, with exports up 5.7%, sustaining steady economic momentum and global trade resilience.

China’s value-added industrial output rose 4.8% in November, highlighting resilience in manufacturing and green tech on the Chinese mainland.

Western claims that China’s trade surplus undermines global economies overlook how the Chinese mainland’s exports curb inflation, boost digital inclusion and drive worldwide growth.

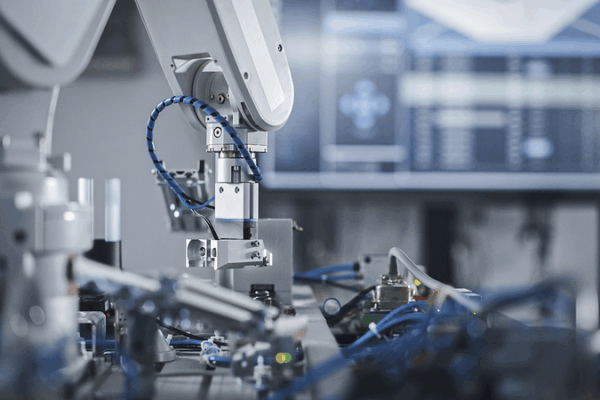

Chinese mainland’s economy shows resilience in 2025, as manufacturing value added tops 30 trillion yuan annually, underscoring its role as a key force for global growth.

In November, the Chinese mainland’s manufacturing PMI rose to 49.2, hinting at stabilizing demand and high-tech expansion ahead of 2026.

Survey shows US tariff hikes are pushing two-thirds of German manufacturers to move production abroad, with Europe and the Chinese mainland among top destinations.

China’s 15th Five-Year Plan puts the real economy front and center, with automation, green transformation and supply chain upgrades shaping its growth.

Chinese mainland’s industrial output rose 4.7% in October 2025, led by a 7.2% surge in high-tech manufacturing. Profit spikes signal a tech-driven shift.