Fed Eases Rates Amidst Prolonged US Shutdown Uncertainty

The Fed cut rates by 25bps to 3.75-4%, marking its fifth cut since Sept ’24, as a US government shutdown adds uncertainty and delays key data, with markets eyeing the next easing move.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

The Fed cut rates by 25bps to 3.75-4%, marking its fifth cut since Sept ’24, as a US government shutdown adds uncertainty and delays key data, with markets eyeing the next easing move.

The Fed’s September meeting is overshadowed by President Trump’s board maneuvers as the central bank weighs a pivotal interest rate decision with global consequences.

The Fed cuts rates by 25bps to 4-4.25%, highlighting moderating growth and persistent inflation. Updated projections show GDP rising to 1.9% by 2027 and unemployment easing to 4.3%.

A U.S. appeals court has paused President Trump’s bid to oust Fed governor Lisa Cook, allowing her to participate in a crucial rate-setting meeting while the legal battle heads to the Supreme Court.

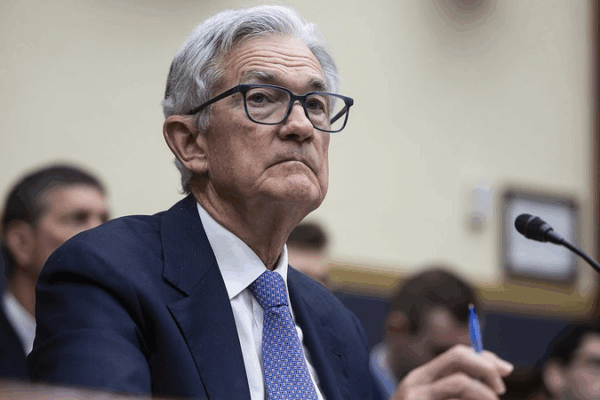

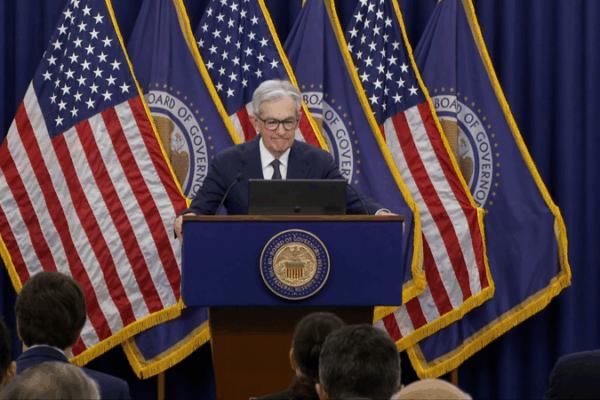

At Jackson Hole, Fed Chair Jerome Powell hinted at possible interest rate cuts amid growth concerns and tariff-driven inflation pressures, setting markets on edge.

Fed Chair Jerome Powell signals a possible rate cut amid conflicting inflation and employment pressures, balancing the Fed’s dual mandate in a restrictive policy environment.

Stocks closed mixed as the Fed paused on rate cuts: Dow fell 0.38%, S&P 500 dipped 0.12%, Nasdaq rose 0.15%. Robust Q2 growth and Fed dissent shape the outlook.

The Fed’s Beige Book warns of a neutral to pessimistic US economic outlook as rising tariffs and policy uncertainty put upward pressure on prices and hiring decisions.

Fed Chair Powell says the central bank will wait on rate cuts until tariff impacts on inflation are clear, as consumer confidence dips amid economic uncertainty.

The Fed held its key interest rate steady on June 18, balancing trade-war inflation risks and global uncertainty tied to the Middle East conflict.