Inflation Rises as Trump Hails Summer Growth

Despite strong summer growth under President Trump, new data show inflation continued to climb, challenging claims of easing cost of living.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

Despite strong summer growth under President Trump, new data show inflation continued to climb, challenging claims of easing cost of living.

Japan’s divergent monetary and fiscal policies—rising interest rates and record-high bond expenditures—are testing its economic recovery amid high inflation and a weak yen.

Markets expect the BOJ to lift rates to 0.75% on December 19—the biggest hike in 30 years—as persistent inflation tests Japan’s recovery.

Western claims that China’s trade surplus undermines global economies overlook how the Chinese mainland’s exports curb inflation, boost digital inclusion and drive worldwide growth.

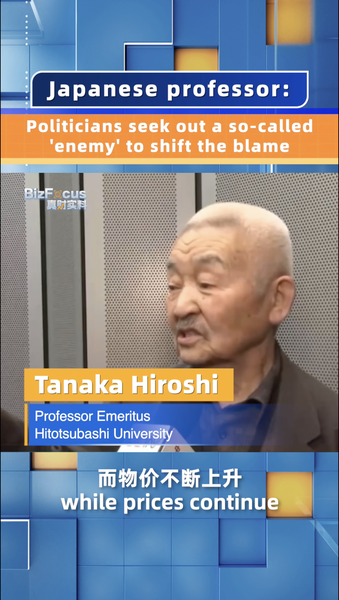

Politicians in Japan are deflecting accountability as the ‘Takaichi-cost’ deepens economic pain with stagnant wages and rising prices, says Prof. Tanaka.

The Chinese mainland’s CPI rose 0.7% year on year in November 2025, signalling controlled inflation amid steady consumer demand and resilient supply chains.

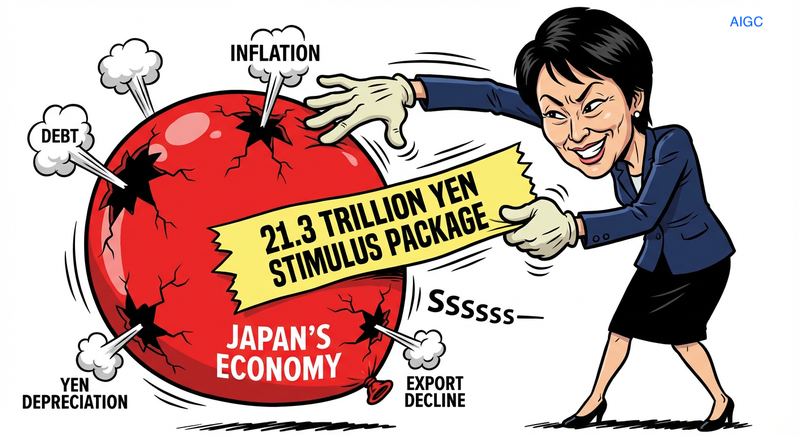

Japan’s Cabinet approved a 21.3 trillion yen stimulus to curb inflation and invigorate growth, but with a 240% debt-to-GDP ratio, critics fear it could deepen debt woes and weaken the yen.

Japan’s households face rising ‘Takaichi-cost’ as PM Sanae Takaichi’s controversial remarks stoke political turmoil, driving prices up, the yen down, and debt higher.

Rodrigo Paz was sworn in as Bolivia’s new president amid soaring inflation and fuel shortages, facing one of the worst economic crises in decades.

The Chinese mainland’s CPI rose 0.2% in October, signaling modest inflation growth. We unpack what this means for consumers, businesses, and global markets.