How Patient Capital is Powering Humanoid Robots on the Chinese Mainland

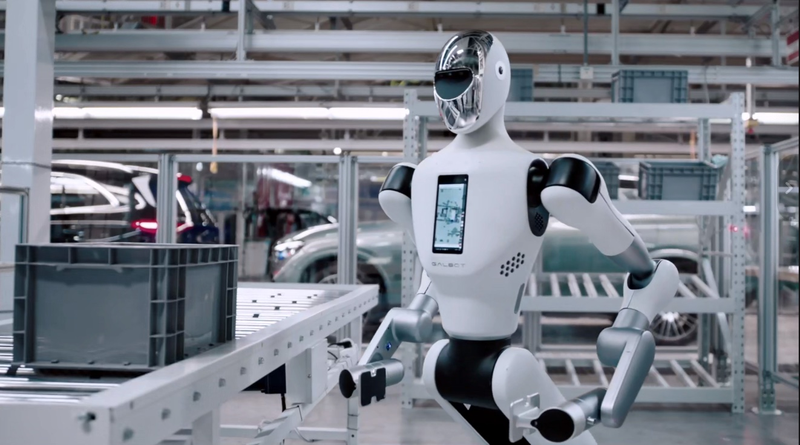

At the Financial Street Forum, experts praised patient capital for powering the Chinese mainland’s humanoid robotics revolution, from AI+ initiatives to mass-market rollouts, sparking global investment interest.