China’s Central Bank Launches $70B Relending Program to Boost Sci-Tech Innovation

China’s PBOC unveils a $70 billion relending program to support sci-tech innovation and technological upgrades, fostering growth in key sectors.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

China’s PBOC unveils a $70 billion relending program to support sci-tech innovation and technological upgrades, fostering growth in key sectors.

China and the United States pledge to enhance communication on economic and financial matters, focusing on balanced growth, financial stability, and sustainable finance.

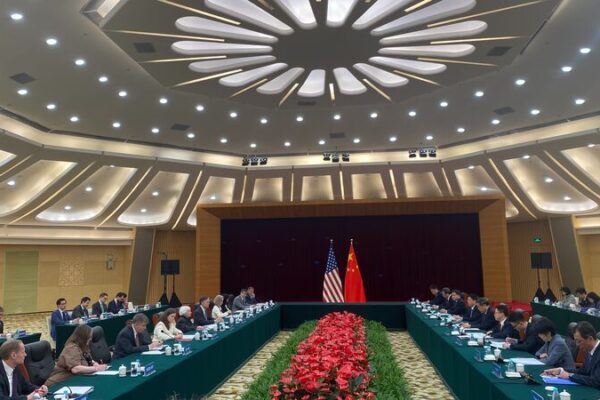

Pan Gongsheng, governor of China’s central bank, met with U.S. Treasury Secretary Janet Yellen in Beijing, signaling key economic discussions between the two countries.

Chinese Vice Premier He Lifeng and U.S. Treasury Secretary Janet Yellen engage in productive talks to enhance China-US economic relations and address global economic challenges.

China’s central bank announces intensified monetary policies to maintain liquidity, guide economic growth, and reduce financing costs for businesses and individuals.

Ethiopia’s state minister praises China as a model for African countries, highlighting plans for collaboration in technology and financial sectors.

Chinese Vice Premier He Lifeng and IMF Managing Director Kristalina Georgieva discussed the global economy in Beijing, emphasizing China’s role in fostering stability and high-quality development.

China’s securities regulator, CSRC, unveiled new policies to enhance market supervision, integrity of listed companies, and investor protection.

The Chinese mainland’s Ministry of Finance has issued ¥12 billion in renminbi-denominated treasury bonds in Hong Kong, reinforcing its role as a key financial hub.

A CPPCC member urges firms from the Chinese mainland to expand in Hong Kong, enhancing its role as a global financial hub and exploring Belt and Road financing opportunities.