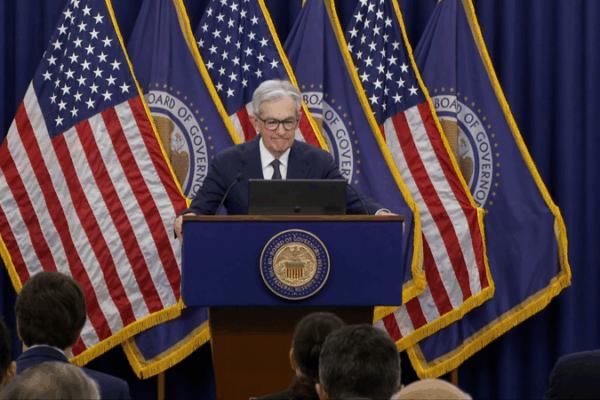

US Fed Cuts Interest Rates by 25bps in Third 2025 Cut

The US Fed on Dec 11 cut rates by 25bps to 3.5–3.75%, its third cut of the year, aiming to stabilize jobs and steer inflation toward 2%.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

The US Fed on Dec 11 cut rates by 25bps to 3.5–3.75%, its third cut of the year, aiming to stabilize jobs and steer inflation toward 2%.

Fed’s Beige Book shows firms cutting staff amid weak demand and uncertainty as prices rise, while officials signal two more rate cuts this year to support growth.

Fed Gov. Cook sues to block Trump’s firing bid, raising stakes in central bank independence and market stability.

President Trump will name a new Bureau of Labor Statistics commissioner in days after firing the previous head, and plans to nominate a candidate for the open Federal Reserve board seat.

The Fed held its key interest rate steady on June 18, balancing trade-war inflation risks and global uncertainty tied to the Middle East conflict.

US inflation slightly eased in January with the PCE Price Index at 2.5%, but remains above the Fed’s 2% target. Consumers expect 3.5% inflation in the next decade.

Federal Reserve Chair Jerome Powell addresses the Jackson Hole symposium, hinting at a potential interest rate cut in September as inflation approaches the Fed’s target.

The Fed’s decision to keep interest rates high continues to strain the global economy, weakening currencies and increasing debt burdens in emerging markets.