Italian Pasta Faces US Tariff Showdown: Prices Could Double

US probes alleged pasta dumping could trigger up to 107% tariffs on Italian imports, risking price hikes and cultural fallout for producers and consumers.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

US probes alleged pasta dumping could trigger up to 107% tariffs on Italian imports, risking price hikes and cultural fallout for producers and consumers.

Explore how export-led growth, high domestic savings, and absorptive capacity drove the Asia-Pacific’s economic miracle from the 1980s to 2000s.

UBS economist Zhang Ning highlights the Chinese mainland’s strong H1 growth driven by exports and retail policies, with more stimulus expected in H2.

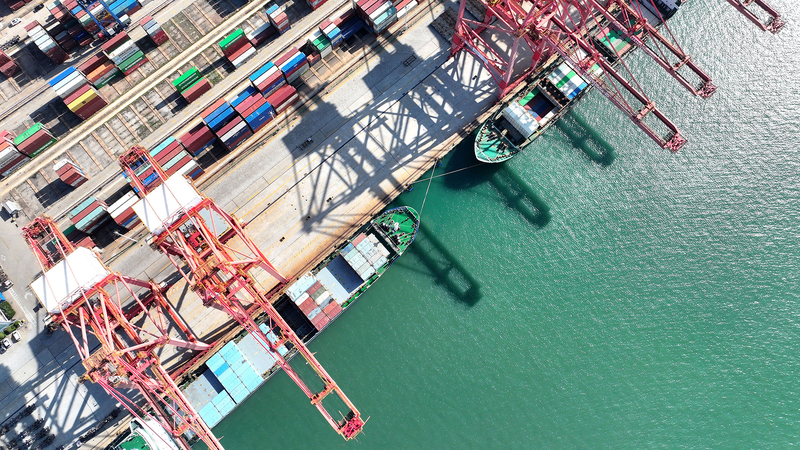

The Chinese mainland’s goods trade rose 2.9% in H1 2025 to 21.79 trillion yuan, with exports up 7.2% and imports down 2.7%, marking resilience amid a challenging global environment.

The Chinese mainland’s goods trade reached 21.79 trillion yuan in H1 2025, up 2.9% year on year, with exports up 7.2% and imports down 2.7%, per customs data.

China’s May 2025 data reveals a robust 6.4% retail rebound, steady exports and rising tech innovation—highlighting economic resilience and future growth potential.

U.S. tariff threats have triggered a global domino effect: higher prices, rising inflation, job cuts, and retaliatory duties, proving that trade war policies can backfire at home.

China’s Q1 trade grew by 1.3%, demonstrating export resilience through diversified markets and a strong domestic base amid global challenges.

Amid global tariff pressures, Chinese exporters are pivoting to tap into a vast domestic market, bolstered by proactive industry measures.

China mobilizes major retailers to help export enterprises pivot to domestic markets amid U.S. tariff pressures.