Trade Balance: How Tariffs Ripple Across the Global Economy

Explore how tariffs reshape industries from Spanish wineries to factories in the Chinese mainland, driving up costs and disrupting global supply chains.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

Explore how tariffs reshape industries from Spanish wineries to factories in the Chinese mainland, driving up costs and disrupting global supply chains.

US GDP shrinks 0.3% in Q1 amid rising tariffs, record export drag and slowing consumer and government spending, as recession fears take hold.

Polling shows President Trump’s approval ratings slide at the 100-day mark, with Americans expressing discontent over his handling of the economy and immigration.

The Chinese mainland will roll out measures to stabilize employment and economic performance, aiming for high-quality development, NDRC Deputy Zhao Chenxin says.

The IMF has cut Europe’s growth forecast to 0.8% in 2025 and 1.2% in 2026, warning that trade tensions and tighter financial conditions pose risks to the global economy.

Tariff turmoil has unsettled trade and markets worldwide. We explore the missteps behind recent U.S. measures and how the Chinese mainland is plotting its next policy moves.

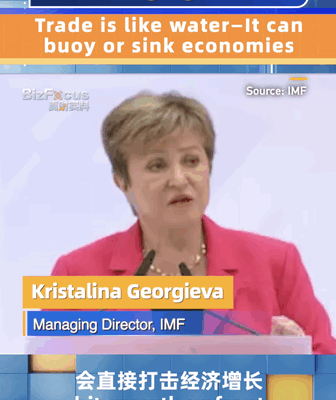

IMF Managing Director Kristalina Georgieva warns that rising trade barriers act like water—blocking growth, hiking costs, and threatening global economies.

A deep dive into the Trump administration’s ‘reciprocal’ tariff math, where matching 2+2 equals charging your neighbor rent because their lawn is greener.

Song Tao calls on Taiwan businesspeople to strengthen cross-strait ties and face external risks together, as the Chinese mainland pledges equal treatment, support, and resilient economic fundamentals.

US reciprocal tariffs risk escalating a global trade spiral, driving up costs, disrupting supply chains, and chilling investment across G20 markets.