China Allocates ¥940M for Flood-Hit Regions Relief

China allocates 940 million yuan to support flood-hit regions, funding crop replanting and farm repairs in Fujian, Guangdong, Xinjiang and Gansu.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

China allocates 940 million yuan to support flood-hit regions, funding crop replanting and farm repairs in Fujian, Guangdong, Xinjiang and Gansu.

China allocates 1.015B yuan for disaster relief to support infrastructure repairs and accelerate community recovery across affected provinces.

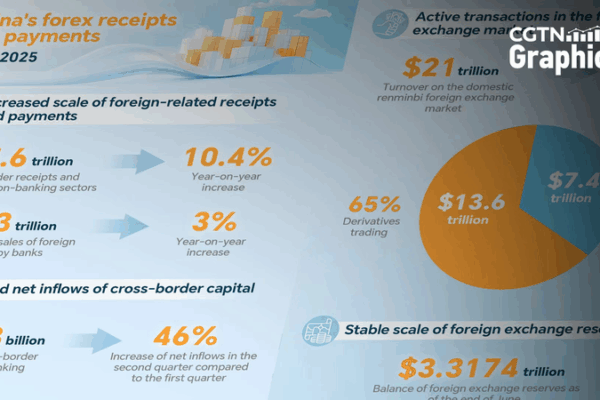

The Chinese mainland’s non-banking sectors recorded $127.3B in net cross-border capital inflows in H1 2025, extending a trend that began in late 2024, according to SAFE data.

Foreign holdings of RMB assets are set to grow, says the Chinese mainlands State Administration of Foreign Exchange. What this means for global investors and markets.

Explore how the Chinese mainland charts a unique course in financial development with Chinese characteristics, balancing innovation, stability, and global integration.

SCIO rolls out a dynamic sci-tech financial policy to bridge research, venture capital and green finance in the Chinese mainland, aiming to boost global innovation and startup growth.

The Chinese mainland announced coordinated rate cuts, SME lending boosts and regulatory tools to stabilize markets and rev up economic momentum.

China’s State Council Information Office briefed the press on a financial policy package to stabilize the market and expectations, with top regulators fielding questions.

China’s financial regulators are opening the markets further, boosting the RMB’s global role and attracting significant foreign investment in bonds and insurance sectors.

China’s financial sector is booming thanks to government initiatives aimed at opening up the market and internationalizing its currency, signaling a stronger global economic presence.