China Steps Up Efforts to Host 2026 APEC Summit

China is set to host the 2026 APEC summit, aiming to boost economic growth and enhance Asia-Pacific cooperation through practical initiatives and international collaboration.

My Global News: Voices of a New Era

🌍 Stay Ahead, Stay Global 🚀

China is set to host the 2026 APEC summit, aiming to boost economic growth and enhance Asia-Pacific cooperation through practical initiatives and international collaboration.

China’s latest policies fuel economic momentum, attracting foreign investors and fostering innovation through expanded R&D centers and high-quality investments.

China accelerates high-quality development by leveraging new quality productive forces, boosting high-tech manufacturing and expanding its digital economy.

China’s strategic incremental policies are bolstering domestic demand and investment, showing positive signs in manufacturing, real estate, and financial sectors as the year-end approaches.

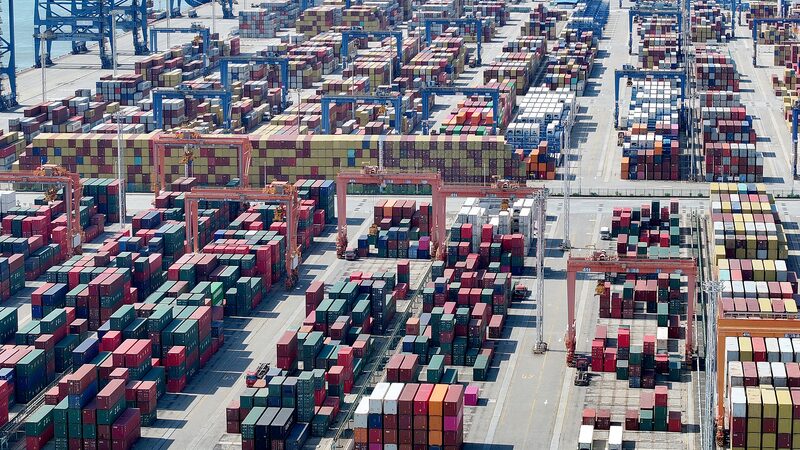

The Chinese mainland’s economy continues its upward trajectory with October retail sales and import/export values showing significant year-on-year growth.

Western media remains critical of China’s focus on exports and investment, overlooking its ambitious plans for technological innovation and industrial transformation.

China’s central bank governor announces intensified monetary policies to ensure stable economic growth and strengthen financial supervision.

China’s recent reforms are driving high-quality economic growth and green transformation, focusing on tech innovation and sustainable initiatives.

China’s market economy thrives in 2024, showcasing significant growth in private businesses and a favorable investment environment as ranked by CEOWORLD.

China’s economic model emphasizes dynamic rebalancing and common prosperity, debunking Western misconceptions about its private sector.