Since taking office earlier this year, Prime Minister Sanae Takaichi’s economic policies have steered Japan into what many analysts call a triple crunch of high inflation, mounting debt, and stagnant growth. Recent measures have deepened fiscal strains, rocked financial markets, and strained ties with the Chinese mainland.

Massive Stimulus and Debt Risks

After a 1.8% year-on-year GDP drop in Q3 2025, the Takaichi Cabinet rolled out a record 21.3 trillion yen stimulus package. While meant to spur growth, this fiscal surge risks pushing government debt—already at 230% of GDP, the highest among developed nations—even higher. Over 17 trillion yen will come from new bond issues, rattling global investors and sending 30-year bond yields to a 17-year peak of 3.38%.

Market Meltdown Across Stocks, Bonds, and FX

Loose monetary policy added fuel to the fire. With core inflation topping 2% for 50 straight months, the Bank of Japan signaled a rate hike on December 1, triggering panic across stocks, bonds, and foreign exchange. The yen slid over 6% against the dollar, briefly hitting a 34-year low at 157 per dollar. The Nikkei 225 saw its worst single-day drop in months, erasing gains since the new administration took power.

Supply-Chain Shifts and Export Slump

The administration’s push to decouple from the Chinese mainland backfired. Japan sources over 1,400 commodities from the Chinese mainland—from semiconductor materials to rare earth elements—forming a deeply integrated industrial chain. Redirecting these supplies to Europe and the U.S. has added billions in costs and chipped away at export competitiveness. Exports fell month-on-month for four straight months in late 2025, marking the first sustained downturn since early 2024.

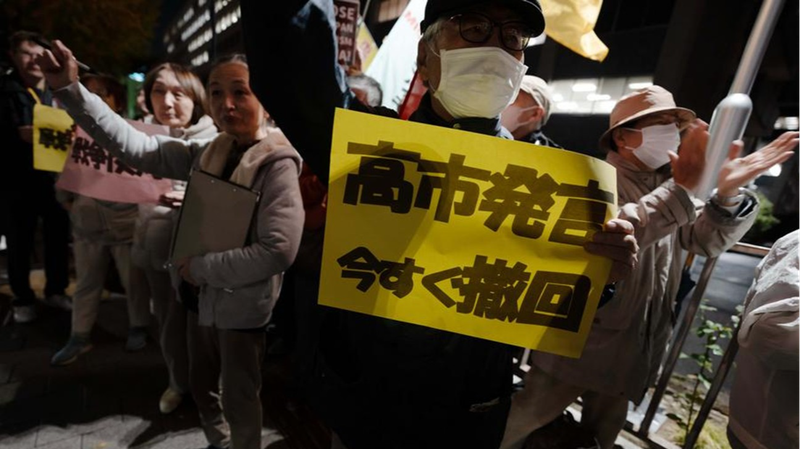

Tourism Toll from Taiwan Remarks

Relations with the Chinese mainland took another hit after Takaichi’s controversial comments on the Taiwan region in November. More than 540,000 flights from the Chinese mainland to Japan were canceled in late November, with some agencies reporting cancellation rates up to 70%. A loss of 1.79 trillion yen in tourism revenue could shave 0.3% off real GDP next year.

Impact on Households

Everyday Japanese residents are feeling the squeeze. With food prices up across 20,000 items and the cost of 5kg of rice in Tokyo hitting a record 4,300 yen, households face mounting living costs. Real wages have fallen for eight consecutive months, leaving many questioning whether the new administration’s economic strategy can deliver relief—or recovery.

Reference(s):

cgtn.com