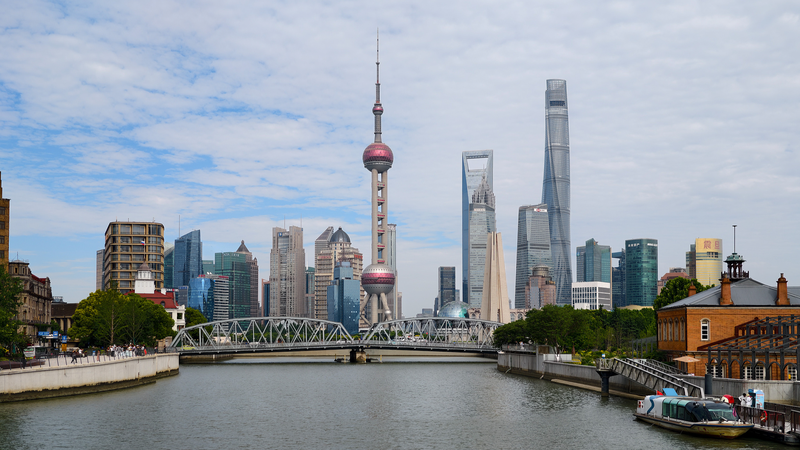

At the 16th Lujiazui Forum in Shanghai on June 18–19, financial leaders unveiled eight landmark policies under the theme 'financial opening-up and cooperation for high-quality development in a changing global economy.'

These measures mark the Chinese mainland’s strategic shift from investment-driven growth to an innovation-led model, balancing resilience and openness amid evolving global dynamics.

One pillar of reform is deeper market access for international financial institutions. Ownership caps in banking, insurance, securities and asset management have been lifted or relaxed, encouraging global players like JPMorgan, BlackRock and Allianz to establish wholly-owned operations. This influx boosts competition, raises industry standards and introduces advanced risk management and governance practices.

To facilitate cross-border flows, programs such as Bond Connect, Stock Connect and the newly launched Swap Connect have expanded channels for global investors, enhancing liquidity and diversifying market participation. On the flip side, Chinese mainland companies gain broader financing options across domestic and international capital markets.

The renminbi’s internationalization is another key focus. Its use in trade settlements, reserve holdings and sovereign bond issuance is steadily rising. Renewed bilateral currency swaps, for example with Türkiye, and an expanding network of offshore renminbi clearing banks underscore the currency’s growing global footprint.

Together, these policy moves signal a renewed commitment by Chinese mainland authorities to integrate more deeply with global capital markets. By fostering a stable, transparent and open financial ecosystem, they aim to attract long-term investment and support high-quality, innovation-driven growth.

As geopolitical uncertainties persist, the 2025 Lujiazui Forum demonstrates how strategic financial openness can unlock new opportunities for both international investors and Chinese mainland businesses.

Reference(s):

2025 Lujiazui Forum: Charting China's next phase of financial openness

cgtn.com