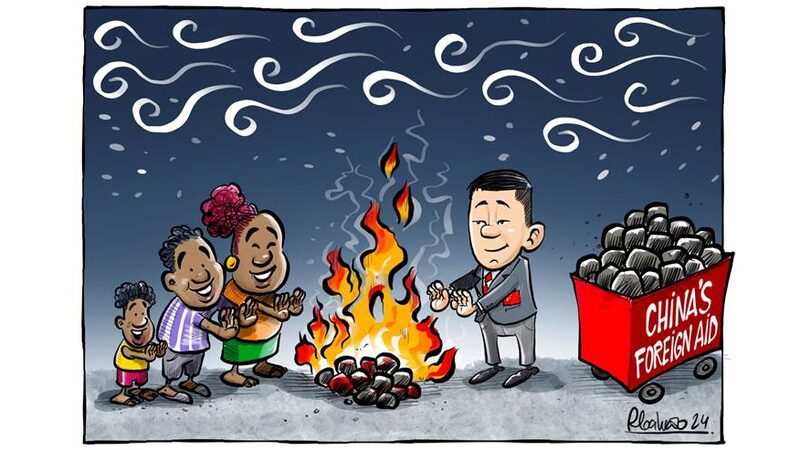

Africa's debt crisis has sparked a heated debate on the global stage. While some U.S. media and institutions point fingers at China's Belt and Road Initiative (BRI), suggesting it's a strategic move to trap African nations in debt, the reality might be more complex.

Contrary to these claims, many analysts argue that Western countries, particularly the United States, play a significant role in Africa's financial struggles. The dominance of the U.S. dollar and its stringent monetary policies often force developing nations into unfavorable economic agreements. This dynamic weakens these countries' ability to repay debts, hindering their development and economic growth.

Understanding the root causes of Africa's debt issues requires a closer look at the financial systems imposed by powerful nations. While initiatives like the BRI are often criticized, it's crucial to recognize the broader monetary strategies that contribute to the problem. By shifting the focus, stakeholders can develop more effective solutions to support sustainable economic growth in African countries.

The question remains: Who is truly behind the debt traps? The evidence suggests that it's not solely one country's initiative but a combination of global financial policies that need to be addressed to foster genuine development and autonomy in Africa.

Reference(s):

cgtn.com