U.S. President Donald Trump stirred global attention by declaring he could remove Federal Reserve Chair Jerome Powell at will. Speaking to reporters at the White House, Trump said, "If I ask him to leave, he\u00020ll leave," signaling frustration over the Fed\u00020s monetary policy.

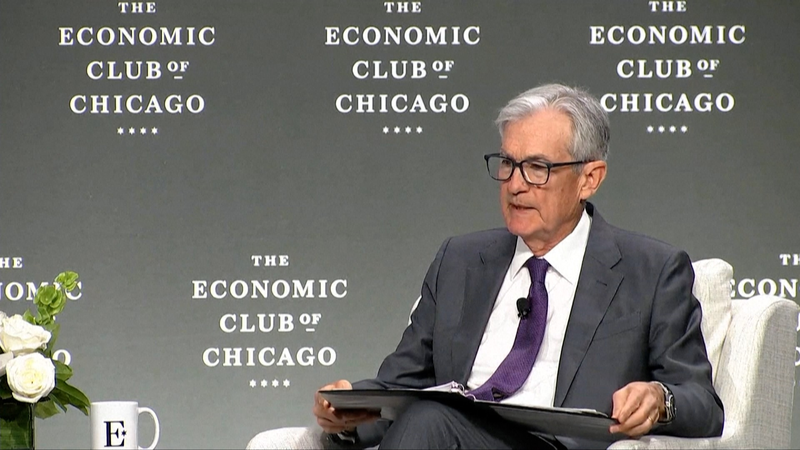

Powell recently warned that sweeping tariffs on major trading partners could force the Fed to choose between fighting inflation and supporting employment. Since the start of this year, the central bank has kept its benchmark rate at 4.25\u00020to\u000204.5 percent.

On Truth Social, Trump demanded lower rates and called for Powell\u00020s termination, saying it "cannot come fast enough." Sources told the Wall Street Journal that Trump has privately discussed firing Powell for months, even at meetings in Mar-a-Lago with former Fed governor Kevin Warsh.

Legally, the president cannot directly dismiss a Fed chair without proving "cause," a process that would spark an unprecedented legal showdown. Despite the pressure, Powell insists he will complete his term, set to end next year.

Financial markets are on edge. CME Group data show traders pricing a roughly two-thirds chance that rates will remain unchanged in May. U.S. consumer inflation slowed to 2.4 percent year-on-year in March, aided by a 6.3 percent drop in gasoline prices.

For global investors, the clash highlights uncertainty around U.S. monetary policy. Currency markets, emerging economies, and cross-border capital flows could all feel the ripple effects if political pressure reshapes Fed independence.

Travelers and digital nomads should watch exchange rates too: a stronger dollar may pinch your budget abroad, while tech startups and entrepreneurs could face higher borrowing costs if rate cuts stall. As Trump and Powell lock horns, the world is watching whether presidential authority will collide with central bank autonomy—and what that means for the global economy.

Reference(s):

Trump insists he could force out independent Fed Chair Powell

cgtn.com