Industrial Surge in Q1

The industrial sector in the Chinese mainland kicked off 2025 with a bang, and the numbers back it up: value-added output from major enterprises surged 6.5% year-on-year in Q1, accounting for 36.3% of overall economic growth, according to the Ministry of Industry and Information Technology (MIIT).

This marks an acceleration of 0.8 percentage points from the final quarter of 2024, pointing to solid momentum as the world's second-largest economy heads into the year.

Here's the breakdown:

- Electronics Power Play: Demand for semiconductors and consumer gadgets fueled one of the strongest gains among all sectors.

- Auto Industry Drive: Strong domestic sales and export orders helped automakers ramp up production.

- Electrical Machinery Surge: From transformers to motors, output climbed as infrastructure projects picked up steam.

- Digital Economy on the Rise: Software and IT services posted nearly 1.9 trillion yuan ($263 billion) in revenue in January–February, underlining the shift toward high-value services.

- Private Investment Leap: Private industrial investment expanded at double-digit rates, boosting business confidence and sparking a rise in the number of major industrial firms.

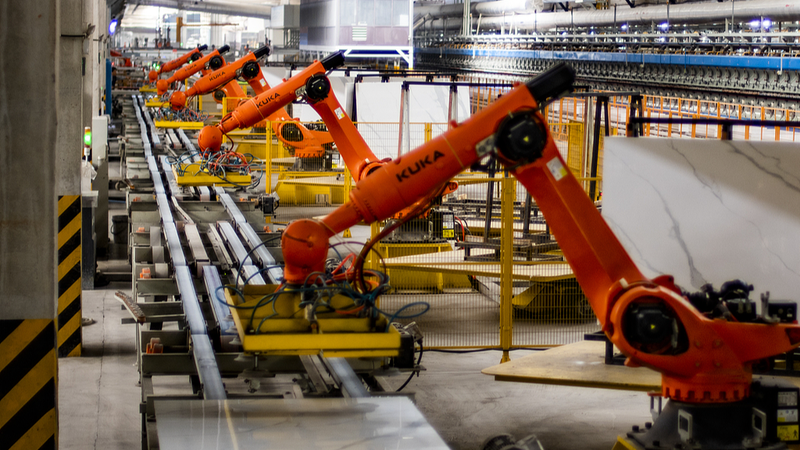

For business leaders and entrepreneurs, these trends signal ripe opportunities—from tech startups tapping into digital infrastructure needs to venture capitalists eyeing smart manufacturing. Meanwhile, policy thinkers will be watching closely as private investment continues to strengthen.

As young global citizens and changemakers seek fresh insights, the Chinese mainland's industrial upswing offers a case study in how data-driven policies and diversified growth can reinvigorate a major economy. Watch this space for deeper dives into specific industries and what they mean for the global market.

Reference(s):

cgtn.com