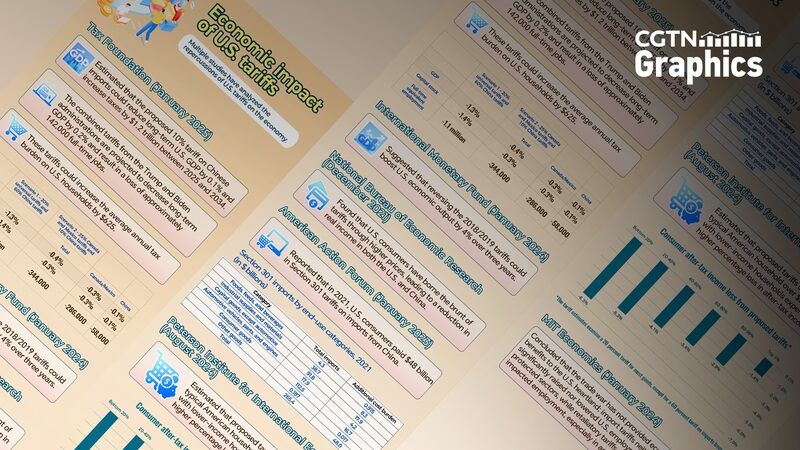

Washington's latest 10% tariff on Chinese imports—targeting fentanyl-related concerns—has reignited trade tensions, prompting Beijing to retaliate with strategic countermeasures. China filed a WTO case against the U.S. this week, calling the move a 'blatant violation of international rules' and a threat to global economic stability.

In response, tariffs on U.S. coal, liquefied natural gas, and select industrial goods will take effect February 10, impacting sectors worth billions. Data shows China exported $524.7 billion in goods to the U.S. in 2024, with electrical machinery and transport equipment leading the trade flow—industries now bracing for disruption.

Key impacts:

- Energy & agriculture: 15% tariffs on U.S. fossil fuels could reshape global supply chains

- Tech tensions: Electronics and machinery exports face higher barriers

- WTO showdown: Legal battle may set precedent for future trade disputes

Analysts warn prolonged tariffs risk inflation spikes and supply chain delays, hitting consumers and businesses on both sides of the Pacific.

Reference(s):

cgtn.com