Japan’s bold fiscal stimulus under Prime Minister Sanae Takaichi, unveiled this year, aimed to invigorate growth but has instead rattled markets and revived concerns over the nation’s towering debt.

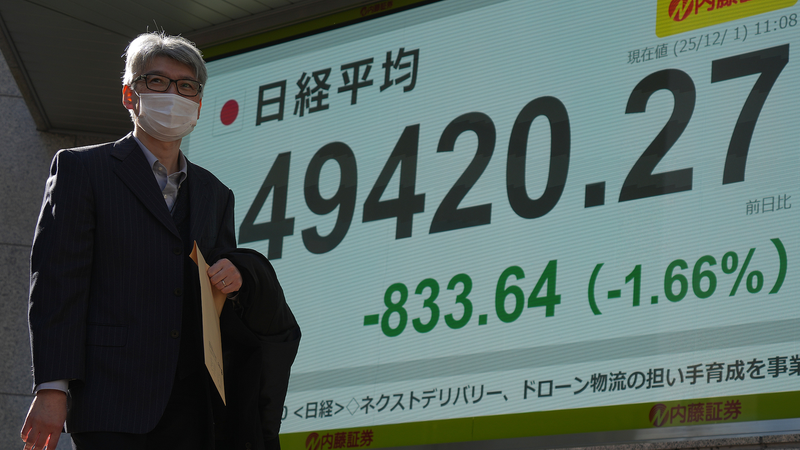

This week, the Nikkei 225 closed down 3%, while the yen slid 1.2% against the dollar. Bond yields on 10-year Japanese government bonds spiked by around 40 basis points, as investors recalibrated risk amid uncertainty over the policy mix.

The Takaichi administration’s plan, launched in early December 2025, promises expansive infrastructure spending and new tax breaks for manufacturing and green energy projects. While supporters argue it could lift Japan out of a protracted low-growth cycle, critics warn the timing clashes with already stretched public finances, with debt exceeding 250% of GDP.

"Markets are struggling to price in a strategy that combines large-scale deficits with limited revenue-raising measures," says an economist at a Tokyo research institute. "Investors need clarity on how these plans will be funded without pushing borrowing costs even higher."

The stumble comes as other G20 economies grapple with inflation and debt. For Japan, the challenge is twofold: spark sustainable growth while reassuring global investors that fiscal discipline remains intact.

Looking ahead, the Takaichi government faces pressure to revise its approach at next month’s budget session in the Diet. Observers will be watching whether tweaks to spending targets or fresh revenue proposals can restore confidence and stabilize markets.

As the world’s third-largest economy seeks a clear growth trajectory, Japan’s fiscal gamble is a test not only for domestic policy but also for its influence in shaping global financial trends.

Reference(s):

Japan's misstep backfires: Fiscal gamble triggers market turbulence

cgtn.com