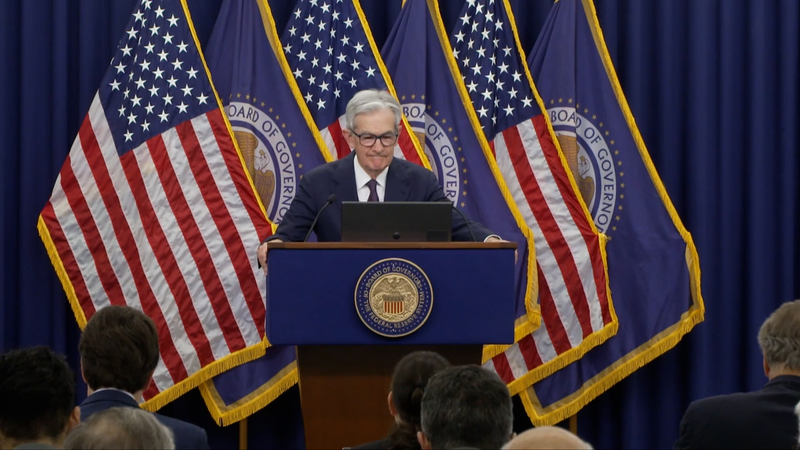

On June 18, the Federal Reserve opted to keep its benchmark interest rate unchanged, a move driven by mounting worries that inflation could resurge under the weight of tariffs from the U.S.-China trade war.

But the Fed’s calculus doesn’t stop at borders. Emerging tensions between Israel and Iran add another layer of complexity, with potential knock-on effects for energy markets and global supply chains.

For startups and young professionals, a steady-rate environment can mean more predictable borrowing costs. Yet, the interplay of tariff-driven price pressures and geopolitical flashpoints urges businesses and investors worldwide to stay vigilant.

As the world watches, the Fed’s next policy meeting will be a pivotal moment—one that could redefine the economic outlook for digital entrepreneurs in Bangalore, exporters in Frankfurt, and market watchers from São Paulo to Singapore.

Reference(s):

cgtn.com