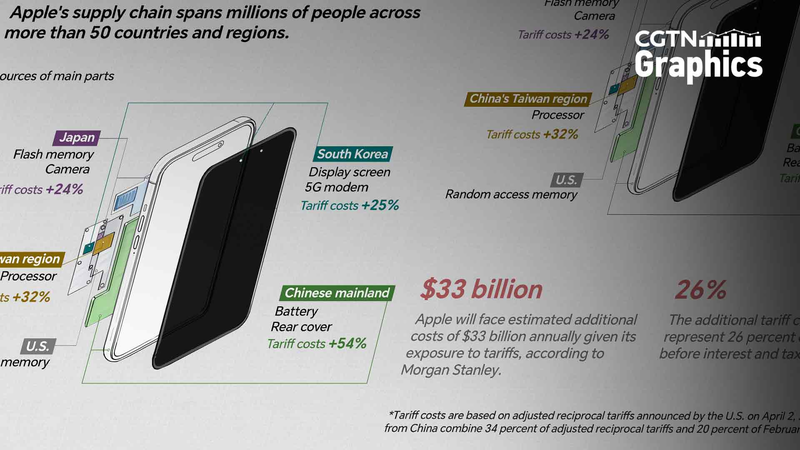

For decades, Apple has woven a supply chain that spans more than 50 countries and regions, employing millions worldwide. But after the U.S. announced new reciprocal tariffs on April 2, this intricate ecosystem faces unprecedented uncertainty.

Under the adjusted policy, tariff rates jump to 24 percent for Japan, 25 percent for South Korea and 32 percent for China's Taiwan region. When combined with previous duties on Chinese goods, Apple's iPhones, iPads and MacBooks could see 34 percent of adjusted reciprocal tariffs plus 20 percent in February levies.

Morgan Stanley estimates that Apple will incur an extra $33 billion in annual costs: amounting to roughly 26 percent of its projected earnings before interest and taxes in 2025. For a company used to razor-thin margins, that's a seismic shift.

What does this mean for global consumers and entrepreneurs? Higher production costs often ripple through to retail prices, supply adjustments and strategic pivots. Some analysts predict Apple may accelerate diversification into India, Vietnam or other emerging manufacturing hubs to soften the blow.

As Apple navigates this new trade landscape, all eyes will be on how the tech giant balances cost management, innovation and its commitment to global stakeholders. One thing is clear: in an interconnected world, even the most powerful brands can't escape the ripple effects of shifting trade policies.

Reference(s):

Graphics: Apple's supply chain under pressure from U.S. tariffs

cgtn.com