In Cixi, Zhejiang Province on the Chinese mainland, home appliance manufacturers are rewriting their playbook after Washington slapped on fresh U.S. tariffs. Once reliant on America for roughly 16% of exports, local firms now face inventory backlogs and paused orders.

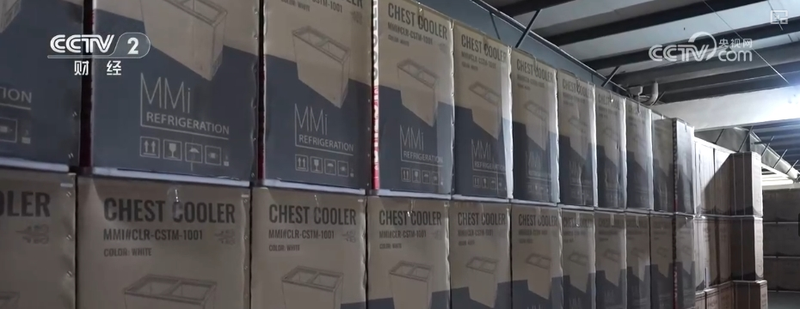

At one leading factory, manager Shen Xuejiang revealed refrigerators and washing machines bound for U.S. customers piled up to nearly 3,000 units once tariffs kicked in. Thanks to a 30% prepayment requirement and 70% parts commonality across models, the team plans to repurpose stock for other markets. 'Even if U.S. buyers default, the deposit covers most repackaging costs,' Shen explained.

Still, losing about one-third of orders poses a major challenge. Production director Ma Pinlei says lines once dedicated to the U.S. market have been retooled for clients in Italy, Mexico and Argentina—among more than 90 countries now served. 'Market diversification is our key risk‑mitigation strategy,' Ma notes. Relaxed minimum order volumes, down from 20 to as few as eight or 10 containers, have helped maintain steady overseas demand.

On the home front, a robust 'trade‑in for new' policy and hefty national subsidies have driven tens of millions of yuan in sales this year. Manufacturers are gearing up for an even larger subsidy program in 2025. Despite the U.S. market pause, Shen says full‑year performance targets remain unchanged.

Local authorities are stepping in to help. The Cixi Youpin Pavilion—an integrated showroom featuring over 1,500 products—lets buyers tap directly into factories, bypassing intermediaries. Japanese importer Hayakawa Taiji praised the setup: 'We can compare various products in a short time.' To widen reach, the pavilion has opened display centers in Vietnam, Thailand and Laos.

Centralized handling of product certifications has also slashed approval times from five or six months to just 45 days, says pavilion director Lu Yingzhen. Meanwhile, a Cixi Commerce Bureau survey flagged tariff‑induced pains—stranded inventory, paused orders and disrupted payments.

An interdepartmental task force is now coordinating measures to help exporters shift to domestic channels. E‑commerce platforms have launched exclusive foreign‑trade product zones, offering marketing support and traffic incentives. Sanitary ware producer Pan Xi’an even rolled out 'digital human' livestreaming technology to promote 24/7 online sales, cutting costs and boosting domestic outreach.

Looking ahead, the commerce bureau plans trade fairs and matchmaking events to guide foreign‑trade firms into local retail chains and supermarkets. With government bodies, industry players and tech partners working in concert, Cixi’s appliance sector is charting new growth paths—and ensuring its products keep 'flying southeast' to emerging markets.

Reference(s):

Zhejiang’s Cixi Home Appliance Firms Diversify as U.S. Tariffs Bite

cctv.com